take home pay calculator married couple

If the spouse died after the end of 2011 the widow or widower can still be classified in the tax class III band. For tax filing purposes this would be the same as your Adjusted Gross.

Income Expense Sheet For Couples Roommates Expense Sheet Budget Template Financial Planning For Couples

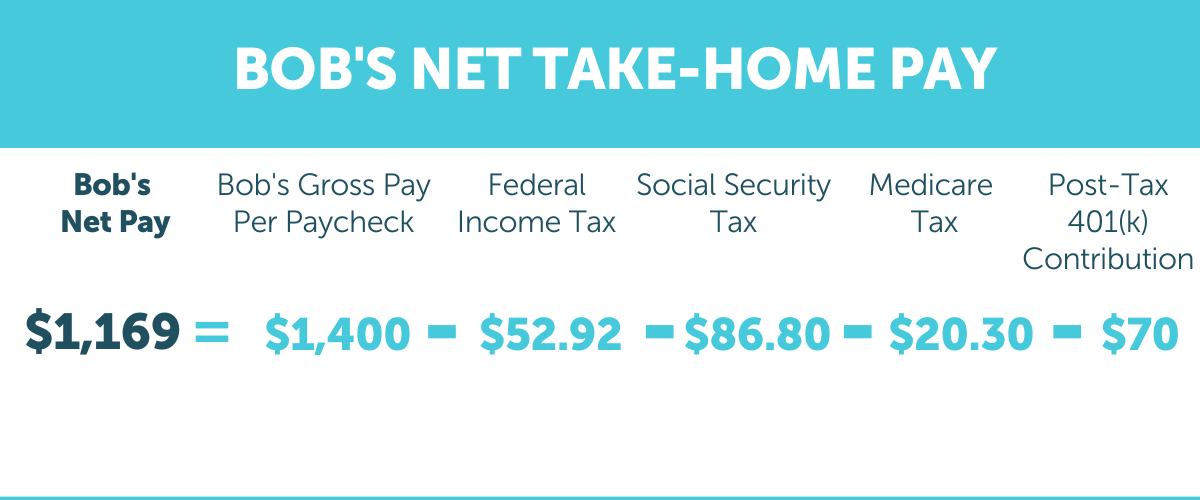

This is your total taxable income for the year after deductions for retirement contributions such as 401 ks IRAs etc.

. For example for 5 hours a month at time and a half enter 5 15. If married your spouses income 9. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Dont want to calculate this by hand. 2021 - 2022 Income Tax Brackets. There are two options in case you have two.

This tool uses standard setting to support standard comparison. This calculator is up to date for the 2022-2023 tax year. How to use the Take-Home Calculator.

This is recommended if both. Retirement planning is complicated. Take Home Pay Calculator 2022-2023.

The married couple must have resided together in Germany up until that point in time. Single Head of Household. If Yes - how much do you pay.

The average monthly net salary in France is around 2 157 EUR with a minimum income of 1 149 EUR per month. Our Home Buying Expert. Conversely the couple receives a marriage bonus if the partners pay less income tax as a married couple than they would pay as unmarried individuals.

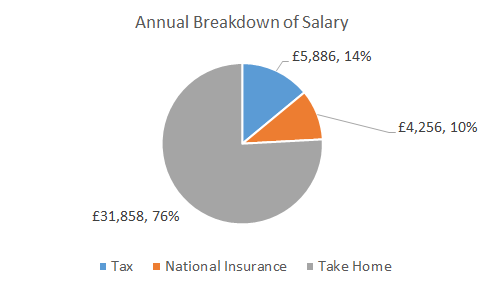

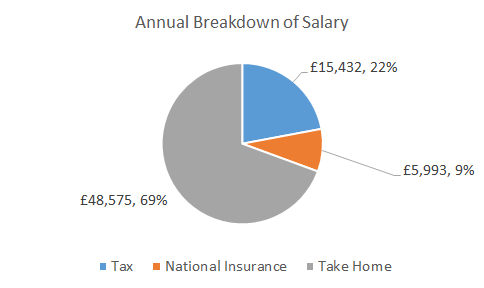

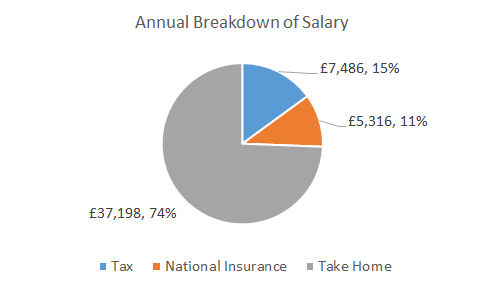

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. 250000 for married taxpayers filing jointly. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

By default the calculator selects the current tax year but you can change this to a previous tax year if desired. Use the US Salary Comparison Calculator. You need to be married or in a civil partnership to claim.

Select your age range from the options provided. Does your employer pay your health insurance subscriptions. Enter your annual salary or the one you would like in the Salary box.

The PaycheckCity salary calculator will do the calculating for you. This calculator lets you create specific situations to see how much federal income tax two. Single Head of Household.

Find out the benefit of that overtime. Unlike most EU member states France does not withhold income taxes from the monthly income. Meaning a single person is 1 a married couple is 2 and any additional children are counted as an additional individualread more.

This places France on the 11th place in the International Labour Organisation statistics for 2012 after the United Kingdom but before Germany. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. In New Jersey single filers who earn 100000 a year pay a tax rate of 6375 with joint filers paying 5525.

For tax purposes whether a person is classified as married is based on the last day of the tax year which means that a person married on the last day of. The wage can be annual monthly weekly daily or hourly - just be sure to configure the calculator with the relevant frequency. Married dual earners can apply for the tax class IV.

125000 for married taxpayers filing separately. Calculate your take home pay in Switzerland thats your salary after tax with the Switzerland Salary Calculator. The salary comparison calculator allows you to compare up to 6 salaries side by side.

Subtract any deductions and payroll taxes from the gross pay to get net pay. The Retirement Calculator for Married Couples or Any CoupleSeptember 29 2021 by Kathleen Coxwell. Single Married Filing Separately.

Take-home salary for single filers. To wrap it all up there will be a quick comparison between the take home pay from the year before so you can see how much what you take home has changed. You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get.

Use Deloittes Irish Tax Calculator to estimate your net income based on the provisions in the latest Budget. More information about the calculations performed is available on the about page. This tool uses standard setting to support standard comparison.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Use the US Salary Comparison Calculator. Single Head of Household.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Retirement planning when you are married or part of any kind of committed couple is doubly complicated. Do you employ a carer for an incapacitated person.

This is your total annual salary before any deductions have been made. A quick and efficient way to compare salaries in Switzerland review income tax deductions for income in Switzerland and estimate your tax returns for your Salary in SwitzerlandThe Switzerland Tax Calculator is a diverse tool and we may refer to it as the. Well go one step further and show you which tax bands you fall into too.

The salary comparison calculator allows you to compare up to 6 salaries side by side. Enter the number of hours and the rate at which you will get paid. The state also has the highest property taxes in the nation at 221.

Take-home salary for married filers. You can select different states and different tax years to produce a range of different salary comparisons for different filer status single married filing jointly widower etc. Rates - PIT is collected on progressive rates that varies from 0 to 45 Plus a surtax of 3 on the portion of income that exceeds EUR 250000 for single persons and EUR 500000 for a married couple and 4 of income that exceeds EUR 500000 for a single person and EUR 1 million for a married couple.

Our free budget calculator based on income will help you see how your budget compares to other people in your area. If you are married you need to use a retirement calculator for married couples or a retirement. See where that hard-earned money goes - with Federal Income Tax Social Security and other deductions.

The following applies to income tax 2013 for widowed persons. It goes without saying that taxes eat into your take-home pay and. A couple pays a marriage penalty if the partners pay more income tax as a married couple than they would pay as unmarried individuals.

Use tab to go to the next focusable element. To find out your take home pay enter your gross wage into the calculator. This number is the gross pay per pay period.

You can select different states and different tax years to produce a range of different salary comparisons for different filer status single married filing jointly widower etc.

25000 After Tax 25k Take Home Pay 2021 2022

Here S How Much Money You Take Home From A 75 000 Salary

Financial Planning For Married Couples Stop Fighting With Your Spouse Over Money Financial Planning Financial Planning Quotes Financial Planning Printables

Do You Want To Hear How Newly Married Couples New Parents Retired Couples And Every Day People Like Y Home Equity Line Money Saving Tips Saving Money Budget

Here S How Much Money You Take Home From A 75 000 Salary

How Much Would Be My Take Home Pay With 7 50 000 Inr Per Annum Quora

Salary Calculator Your Take Home Pay Blue Arrow

25 Things To Know Before You Get Engaged Getting Engaged Engaged Wedding Proposals

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Hourly Rate Calculator Plan Projections Service Based Business Rate How To Plan

6 Things To Do For Quick Approval Of Personal Loan Personal Loans Person Axis Bank

Net Worth Calculator Personal Financial Statement Net Worth Event Planning Template